Toggle Navigation

The campaign for former President Donald Trump — along with other Republicans and critics — has taken aim at President Biden over his recent budget proposals, including what they say would be the "largest tax HIKE ever."

The tax increase is part of Biden's $7.3 trillion budget plan for fiscal year 2025, which includes a $4.9 trillion tax hike and calls for an "unprecedented $86.6 trillion in spending" over ten years, according to Republicans on the House Budget Committee. The plan would also lead to the "largest debt in American history" at $54 trillion by 2034, according to the Republicans.

A Trump campaign spokesperson said Biden's plan "would take nearly $40,000 dollars away from the average American family, who is already losing thousands every year due to Biden's record-high inflation crisis."

The former president's campaign said Biden's budget plan was "defined by massive spending increases and tax hikes on Americans" and claimed the "bloated" budget does not address the priorities of the American people.

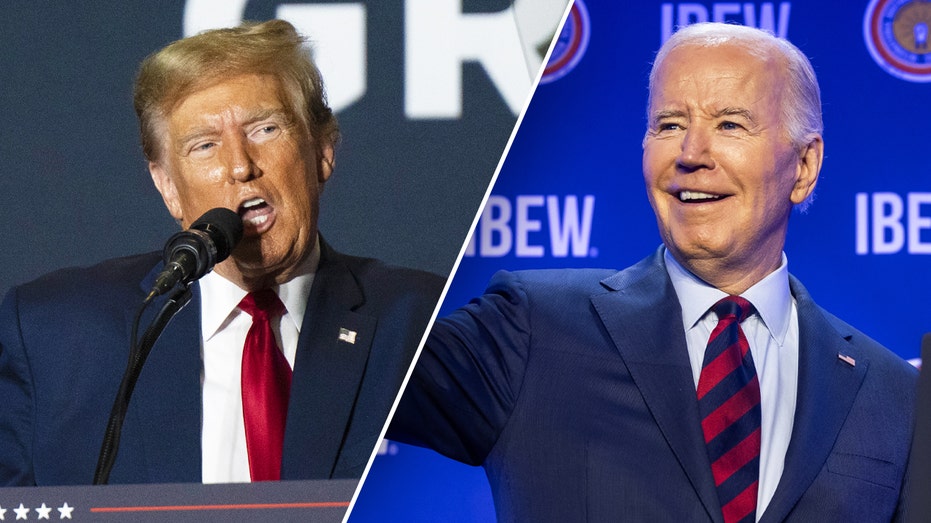

The Trump campaign took aim at President Biden for his budget proposal, which they argued includes the "largest tax HIKE ever" and is "defined by massive spending increases." (Getty Images / Getty Images)

Citing a figure provided by Richard Stern, the director of the Grover M. Hermann Center for the Federal Budget at The Heritage Foundation, Trump's campaign said the tax hikes amount "to almost $36,000 in tax hikes per American family."

Instead of being used to cut the deficit, Brian Riedl, a senior fellow at the Manhattan Institute who focuses on budget, tax and economic policy, argued that roughly half of that revenue would be "plowed into … new entitlement expansions."

"So all these historic, revenue-maximizing taxes would barely even cut the deficit. Most goes to more spending," Riedl wrote in a post to X.

"When President Trump is back in the White House, he will advocate for more tax cuts for all Americans and reinvigorate America's energy industry to bring down inflation, lower the cost of living and pay down our debt," the Trump campaign spokesperson said.

Biden's tax increase proposal would also dramatically raise the rates paid by corporations and wealthy Americans.

As part of the proposal, Biden called for a 25% minimum tax rate on households worth more than $100 million, raising the capital-gains tax rate, quadrupling the corporate stock buyback tax to 4%, raising the corporate tax rate to 28% from 21%, increasing the Medicare tax paid by wealthy Americans, implementing a global minimum tax on multinational corporations and closing the carried interest loophole used by private equity and hedge fund managers.

A report released this month by the Tax Foundation, a group that advocates for lower taxes, found that the higher taxes laid out in Biden's plan would reduce economic output by 2.2% in the long run, slash wages by 1.6% and kill about 788,000 full-time equivalent jobs.

President Biden speaks in Milwaukee, Wisconsin, on March 13, 2024. (Alex Wroblewski for The Washington Post via Getty Images / Getty Images)

Higher taxes on corporations are the "largest driver of the negative" economic effects and alone would trim the nation's GDP by 0.9%, wages by 0.8% and full-time equivalent jobs by 192,000, the study revealed.

Altogether, the tax increases would reduce the federal deficit by about $3 trillion. Money from the newly generated revenue would also help to pay for expensive new programs floated by the president, including a monthly tax credit to help some homeowners offset steep mortgage payments, subsidies for child care and lower prescription drugs.

In the case of the capital gains tax, the proposed changes would "push the United States beyond international norms," according to the Tax Foundation.

The plan stands in contrast to the tax cuts offered during Trump's tenure in the White House. However, millions of Americans could soon face steeper tax bills when massive components of that legislation — known as the Tax Cuts and Jobs Act — expire at the end of 2025.

Signed into law by Trump in 2017, the law drastically overhauled the nation's tax code, including reducing the top individual income tax bracket to 37% from 39.6% and nearly doubling the size of the standard deduction.

However, those changes to the individual section of the tax code are poised to sunset in 2025, meaning that many taxpayers will face steeper levies if the law is not extended.

In addition to lowering the top tax bracket for wealthy Americans, the Trump-era law raised the thresholds for several income tax brackets — essentially lowering the liability for many households.

The expiration of the tax law on Dec. 31, 2025, will essentially mean that many Americans will be forced to pay anywhere between 1% and 4% more in taxes unless certain provisions are extended or made permanent.

Former President Donald Trump during a campaign rally at the Forum River Center March 9, 2024, in Rome, Georgia. (Chip Somodevilla/Getty Images / Getty Images)

The topic is likely to be a source of contention during the general election. Trump has pledged to make the tax cuts permanent if he is re-elected in November. Treasury Secretary Janet Yellen has also suggested that President Biden would seek to retain the tax reductions for Americans earning less than $400,000 during a second term in the White House.

The problem, however, is that the Congressional Budget Office estimates that extending the TCJA would add roughly $3.7 trillion to the federal budget deficit.